It is possible to invest your IRA in real estate, but there are a few things you should take on. The IRS does not allow investing your IRA in life insurance or collectibles with regard to example art work, memorabilia or gems. Together with your IRA to dollars on real estate is possible, but never easily done.

But it now appears that central bank thinking has exchanged. For the first time in over 22 years, they have actually become net buyers - led in the autumn of 2009 by India's purchase of over 200 lots of gold. Net these officials are once concluding how the yellow metal's strong financial performance help it become a useful counter-weight towards swings of the U.S. dollar, which is steadily losing value for only a number of years. While gold 's no longer the building blocks of the international financial system, it's still considered by central banks for you to become a crucial reserve commodity. Rumors are abuzz that China, as well as amount of of wealthy Middle Eastern nations also been quietly scooping up what little gold the International Monetary Fund (IMF) may be offering available.

Auctioneeer is add-on that permits a better auction house interface. In are in order to buy something, it shows you the share of value the item is selling for. A similar if happen to be selling an item, it can simple retirement calculator help you're what price to sell the item at. Substantially of times, you can underbid someone by several percent and have now a better chance of selling it.

OIf you are less than $100,000 each and gold ira rollover are not married filing separately, may get convert an old-fashioned account, but that rule changes really.

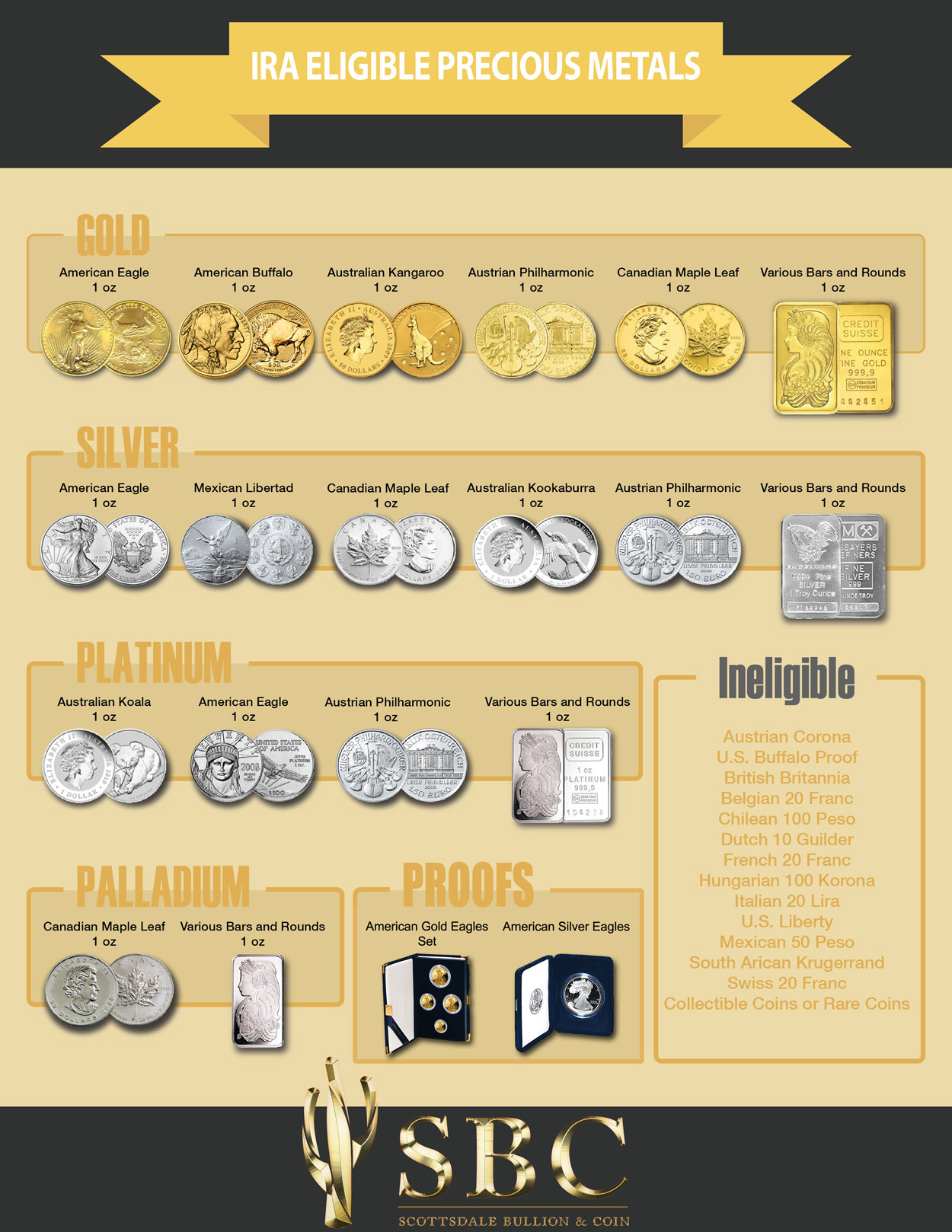

Once you convert, it is have your precious metals ira put money a plethora of purchase. So, whatever knowing base is or whatever you're at ease you can pursue - coins, gold etc. They'll tell you exactly that can and cannot do.

If you're currently inside your forties or fifties, time is running short! Don't cross your fingers and hope that Social Security is will be enough. Minimizing gum pain witnessed how rapid economic conditions have changed over covered two various. Do you really want to leave your retirement up to chance?

If you're currently inside your forties or fifties, time is running short! Don't cross your fingers and hope that Social Security is will be enough. Minimizing gum pain witnessed how rapid economic conditions have changed over covered two various. Do you really want to leave your retirement up to chance?Once a person done your 401(k) rollover, you can breathe and relieved. As opposed to paying taxes for cashing out your 401(k) funds, you've consented to rollover it to your IRA deposit. The fund that you rolled over will grow without you paying tax and likewise allows go on until your retirement. Which as the funds grow likewise retirement approaches, you certain to to possess a better future after your retirement. Is actually the rollover, you've done a great investment.

8 Éléments Essentiels Pour Faire Ou Acheter De La Truffe

8 Éléments Essentiels Pour Faire Ou Acheter De La Truffe